Since I first entered the securities industry in May of 1977 as a trainee with the venerable, old "bond house" known as McLeod Young & Weir Limited, little did I suspect that the business, otherwise referred to as a "random walk" would evolve into a medium of exchange governed by millions of lines of code written by math wizards masquerading as video-game designers. Trained by veteran traders who believed that to be a master trader required a thorough working knowledge of human emotion, they hammered home the notion that it was the conflict between fear and greed that created stock market volatility and that a master's degree in finance was only useful when markets were closed.

Somewhere around the end of the DotCom crash in October of 2002, with the Dow at 7,181, human traders began to migrate from the NYSE floor to the quieter pastures of smaller OTC markets after being replaced by massive mainframe computers designed by companies like IBM and Digital Equipment that could handle 2.5 billion share trading days with nary a bead of sweat compared to their human counterparts that would collapse in exhaustion after a 250-million-share capitalist slugfest.

As sophistication in software programming became more and more advanced over the next two decades, it gradually dawned on me that trading had become noticeably more difficult due to delayed or misdirected fills and or rapid-fire intervention by the high-speed trading machines that could hunt down errant bid and front-run it before one could say the words "Preparation H." After the subprime crash in 2008, late-session stick saves where the markets went from deep losses to healthy gains in a matter of thirty minutes became commonplace.

Then, in the decade covering the post-GFC Crash period from 2009 until 2020, I began to notice that gold and silver markets started to behave irrationally. Technical set-ups where resistance and support levels had been effective gradually began to fail miserably. Trades that I would make in the GDX or GDXJ with my eyes closed would suddenly, out of nowhere, reverse out of tried-and-true break-out or break-down formations and completely blow up.

When the carbon units were responsible for the execution of client orders, they would get reprimanded or fined for "front-running" a client order. High-frequency trading systems run by software programs that utilize pattern-recognition algorithms to trigger buy-and-sell programs actually pay the banks and brokers to get access to their order flow for the sole, unabashed purpose of front-running. The reason they are not reprimanded lies in the money — the obscene fees that the banks and brokers get to allow these sub-human carrion-eaters to front-run your orders, in effect stealing money with the full knowledge and consent of your bank or broker.

On Wednesday evening and into the wee hours of Thursday morning, during the electronic access market trading hours that included the Asian and European sessions, I saw gold rocket to an overnight session high of $2,225.30. In normal markets, this is, by any and all measures, a "breakaway move," where the move to all-time highs means that there are no prior peaks or valleys constituting anything in the form of resistance.

There should have been nothing in the way of congestion areas where volume and price formed a wall where earlier buyers got trapped into a losing long position. Between 9:00 a.m. and 9:30, gold futures continued to trade above $2,200, off the earlier highs but still nicely ahead on the session. However, it was only after the NYSE opening at 9:30 that the market began to really tank, which gives rise to the proposal that it was not the bullion bank Crimex behemoths that bludgeoned the gold price; it was the algobots that run the GLD. By 11:30 Thursday morning, gold had crashed all the way back to $2,167, with the GLD:US sliding from its $203.90 opening to under $200 per share.

With zero resistance above $201, from whence did the wave after wave of selling emanate? Was it all just "normal profit-taking" or simply "long liquidation" by locals? Whatever it was in the eyes of the Bloomberg and CNBC commentators, it sure as hell wasn't normal. When the S&P 500 broke out to new highs above 4,796 a few weeks ago, there was zero resistance above that level, and it simply levitated on light volume as if there were nothing in the way.

That is the way markets act when they are left alone. In the gold arena, there is nothing that can ever occur unless the algobots are instructed to stand clear.

That is the way markets act when they are left alone. In the gold arena, there is nothing that can ever occur unless the algobots are instructed to stand clear.

That new, all-time high in gold, welcomed with open arms and cheering masses in Shanghai and Moscow, was frowned upon by the price managers in London and New York, resulting in an all-out, end-of-week attack on the prices for gold and silver that ended with continuation moves in both metals on Friday that augmented those two key, outside reversal days on Thursday.

Where there should have been a big, beautiful green candle on the weekly chart now remains a big and very ugly red candle suggesting a few more sessions, if not weeks, of consolidation before another run is made at the highs.

I know we have beaten this topic like a rented mule for years, but if it were not for the absurdity seen in the equity markets with extended periods of overbought readings and unfilled gaps, I could accept the status quo, but because this constant massaging of prices everywhere to condone and prolong the desired narrative has gotten out of control, I find myself agitated.

Now, I am not exactly a believer in the sanctity of free market capitalism here in 2024, but I will stand here and swear on a stack of Gideon's Bibles that the U.S. markets are totally and completely rigged. If strong equity markets are critical to maintaining positive sentiment for the American voter, and if strong stocks are to be seen as an omen of strong economic growth, then the famous line used by George H.W. Bush to explain his election loss to Bill Clinton — "It's the economy, stupid." — can be applied in reverse to the importance of keeping stocks "bid" until November.

Everything that comes from the Washington data rooms, whether it is unemployment numbers or retail sales, are "blowout" these days, only to be revised downward a month later to "non-blowout," but since nobody reads the revisions, all they feel is the warm, fuzzy, glow of a vibrant economy.

It is very difficult to trade markets where human decision-making is absent and where the algobots are never to fear a margin call. With a Buffett Indicator running north of 190% right now, stocks are valued for absolute perfection, which means that even the slightest stumble will result in a nasty outcome. However, the only thing driving traders these days is liquidity and momentum, with nary the slightest concern or consideration of value.

Since the week went out with an ugly red candle for the DJIA, it joins both gold and silver in having a challenging end to the week. Since next week is essentially month-end and the termination of the "Best Six Months" for the stock market, perhaps traders are protective of their ill-gotten gains may wish to "Sell in May and Go Away," which couples perfectly with the "Buy

When it Snows; Sell When It Goes" theory of analytical wizardry.

I follow perhaps 100 individuals on social media venues and while many are selected out of courtesy for having followed me, I must confess that the content that I get now from Twitter, or "X," as Elon wants to call it, is dreadful. As a relatively new entrant to the subscription business model, I get the impression that most people would rather get their stock research or "hot tips" for free rather than have to pay for it.

Furthermore, I find that the more one charges, the higher caliber of subscriber one gets. At the end of the day, people will only pay for what they perceive as "good value," so when I wake up every Sunday morning, I try to put myself in the shoes of my subscribers, who either want or need some kind of guidance as to how to problem-solve these insanely overvalued markets.

While I am forbidden from offering investment advice, I can always offer a liberal dollop of common sense, and that, in turn, can be generously applied to the process of investing one's life savings in an environment where literally everyone is trying to take your money. I get ten calls a week on my cell from people whose English I fail to comprehend wanting to sell me "duck work" where their only objective is to get an invitation into my home from some gentleman who may or may not wish to cause me ill will. Since that "gentleman" is probably 40 years younger and infinitely stronger than me, not to mention far more desperate and ten times as eager to make the distance between me and my a) money b) safety, and c) life, I err on the side of caution, and that is precisely what I try to do in my investment strategies.

Uranium Versus Lithium

I have an important confession to make: I was very much "late" to the lithium party, having missed the massive moves in the lithium deals led by big U.S. producer Albemarle Corp. (ALB:NYSE).

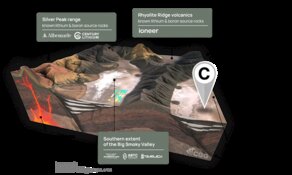

When I finally latched on to the concept of the Electrification Trilogy of metals that features uranium (nuclear energy-created electricity), copper (transmission grid), and lithium (storage), I was already well on my way to establishing big copper positions and I had already been trading Cameco Corp. (CCO:TSX; CCJ:NYSE) to secure a second uranium position after Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX) which was first acquired in 2017 some four years before the incredibly-bullish uranium story was finally accepted.

I went after CCJ in late October after listening to their earnings call and hearing the CEO telling the world that "conditions in the uranium industry have never been better," so I bought a bunch and watched it move up by 25% to over $51 by early January.

When I started looking at the lithium names, I knew that I was playing with fire if I started chasing ALB, so I avoided the lithium "miners" and elected to move to the lithium "briners" instead. It seemed to me that extracting lithium from oilfield brines could achieve positive free cash flow a lot sooner than building a mine in northern Quebec. However, with uranium, I never veered away from my bullish view. In fact, copper and uranium have two of the most rock-solid outlooks of anything in the metals arena today, and unlike gold and silver, they are usually free to trade without the debilitating effects of intervention.

I took profits on uranium in early January for a number of reasons, but the first was that every podcaster, newsletter writer, armchair stock picker, and corner shoeshine boy was rhyming off the five major bullish bullet points espoused in the five hundred Rick Rule interviews in December alone where he reminded everyone how much money he made back in 2004-2007. I could not turn on BNN without seeing a pitch for some junior explorer pitching the viewing public on their "premium land position" in northern Canada located "proximitous" (within 100 km.) to a major uranium showing. However, as tilted was the sentiment needle to <EXTREME GREED> with every novice investor chirping into uranium chatrooms or YouTube channels typing "TO DA MOON" followed by 25 exclamation marks, I have never doubted the substance behind the uranium story for as much as a New York nanosecond.

Today, I am flat all but one: Tisdale Clean Energy Corp. (TCEC:CSE; TCEFF:OTCQB; T1KC:SE) of the uranium names and own a small position in one of the lithium briners Volt Lithium Corp. (VLT:TSV;VLTLF:US) but while I am leery of buying back any of the lithium names, I am now satisfied that the correction in the big uranium names has run its course. I will be looking to add CCJ back to the GGMA 2024 portfolio and will be looking at a few of the juniors as well, including additions to TCEC, which is a uranium resource in the Athabasca Basin that they will attempt to expand with the upcoming drill program.

So, for the record, I am back in the bullish camp for the uranium names, but unfortunately, I cannot say the same for the lithium camp. There is too much supply, too many issues with EV demand, and too many broken-down chart patterns representing trapped longs and shattered dreams.

Copper, gold, and uranium in 2024.

Junior Mining

When I look back on my experiences in the junior mining arena, I can point to a long list of prerequisites for investing in this highly speculative field of endeavor. To be sure, however, the list of red flags is three times as long. First on the list is the caliber of the people involved and their history of either finding economic deposits or building mines on schedule and under budget. Second is the financial commitment to the project — i.e., the amount of "skin in the game" they have exposed.

A great many of the smooth-talking charlatans will boast of their "sweat equity" in the deal, which means that the compensation options they receive should be rewarded for their efforts to enhance shareholder value. That is all fine and dandy, but a lost opportunity has a lot less sting than lost capital, which is why I like to see management and the board of directors have ample "skin in the game."

A great example of this is Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB), where prior to last month, insiders reported a paltry <1% insider ownership. With the appointment of Robert Bass to the role of Chairman in February, the new insider number is >20%, which greatly enhances the optics for prospective new investors.

In my career, one of the biggest passes I ever had was in a little Canadian diamond explorer called Mountain Province Mining Inc. (now Mountain Province Diamonds Inc. (MPVD:TSX)) that had a radiologist as president and a Board of Directors of lawyers and accountants with only one geologist that nobody had ever heard of. However, one of the outside consultants was a geologist named Bill Jarvis, whose responsibility was to analyze the indicator minerals found in glacial trains strewn systematically through the Canadian tundra.

I was educated by Bill Jarvis on the methodology of finding economic diamond deposits using an electron microscope and caustic fusion analysis on those indicators. He would spend hours on the phone with me explaining why he was completely convinced that the low calcium-high chromium G10 garnets found near Kennady Lake were the source of an "economically viable diamondiferous kimberlite pipe."

The logic behind his bullish assumption was infinitely more valuable than any report from a newsletter writer or brokerage industry analyst, so I bought almost the entire issued capital of the company under $.60 and waited for nearly a year until they drilled and wound up hitting the richest diamond-bearing pipe in history grading well over three carats per tonne propelling the stock to almost $10 per share within months.

It was a life lesson for me in that I have always tried to find that certain "Bill Jarvis-type" of individual whose technical competence was often overshadowed by the charismatic pitchmen who fronted the deal. The money managers were always impressed by the money-raisers, and the better the pitch, the more excited the managers got and the more money was invested, but once the money was "in the jar," it was the Bill Jarvis types that would tell the pitchmen where and how to spend it. A valuable life lesson indeed.

On the closing day of PDAC a few weeks ago, I was introduced to my latest version of the Bill Jarvis-type while meeting the management team for Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB)).

Joining Chairman Campbell Smyth and President/CEO Merlin Marr-Johnson was newly-appointed technical advisor Gilberto Schubert, a Chilean national whose C.V. includes Masters in Sedimentary Geology and a Masters in Mining Economics as well as being a Qualified Person for the company. With 32 years of progressive experience across a broad spectrum of the mining industry, including early to late-stage exploration, economic and financial evaluation of projects, planning, development, and mining operations, Gilberto was country manager for the mighty Vale Inc., the multinational Brazilian mining conglomerate.

Vale owned Fitzroy's Caballos Copper project for a number of years, during which Gilberto and his team did extensive geology, geochemistry, trenching, and geophysics while recommending an extensive diamond drill program on a highly-prospective zone that is the target of FTZ's 3,000-metres diamond drill program later this year.

As the moments at the luncheon passed by, I became increasingly excited by Gilberto's sheer knowledge of the Chilean Andes and the Caballos project, with every question I asked being answered with forethought and detail by a man choosing words carefully in a second language so as to avoid any form of miscommunication or confusion. I do not know whether it was his fiery Latin blood or just his technical knowledge of the opportunity, but to observe the obvious change in sentiment when we moved on to discuss the Polimet copper-gold project just down the road from Caballos, Gilberto grabbed my notepad and pencil and began drawing a schematic on the suspected location of an ore zone that could be traced by elevation levels.

He pointed to the other side of the valley where, on the ridge, were located a number of incredibly high-grade mining operations running around 5% copper and 35 g/t gold. As the famous nursery rhyme would recount, I had "visions of sugar plums" dancing in my head as I imagined what Gilberto had planned for Polimet when they launched into the 2,000-metre drill program.

At the end of the day, success in the exploration space depends on whether they get the blessings of the two Divine Divas of the Mining Heavens – Mother Nature and Lady Luck — but having a keystone asset in place, such as Gilberto Schubert has certainly carved a path to the hearts of those two goddesses. And that is a difficult task at the best of times.

| Want to be the first to know about interesting Cobalt / Lithium / Manganese, Uranium and Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- Tisdale Clean Energy Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000. In addition, Tisdale Clean Energy Corp. and Volt Lithium Corp. have a consulting relationship with an affiliate of Streetwise Reports, and pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Cameco Corp. Western Uranium & Vanadium Corp., Tisdale Clean Energy Corp, Volt Lithium Corp., and Getchell Gold Corp.

- Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with Fitzroy Minerals. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.